The discount rate is a key actuarial assumption for the measurement of long term benefit obligations because it is used to calculate the present value of future cash flows. For a typical pension plan in Belgium, a 0.25% higher discount rate may result into a 3% to 4% lower benefit obligation.

This article outlines the different approaches used to determine the discount rate in accordance with IAS 19 Employee Benefits.

The discount rate according to IAS 19

IAS 19.83 prescribes that the discount rate is determined as follows:

“The rate used to discount post-employment benefit obligations (both funded and unfunded) shall be determined by reference to market yields at the end of the reporting period on high quality corporate bonds. For currencies for which there is no deep market in such high quality corporate bonds, the market yields (at the end of the reporting period) on government bonds denominated in that currency shall be used. The currency and term of the corporate bonds or government bonds shall be consistent with the currency and estimated term of the post-employment benefit obligations.“

In other words: if possible, use high quality corporate bonds and, if not, look at government bonds.

Benchmark-based approach

In the first approach, the discount rate is derived from an index. Bond indice providers such as Markit iBoxx and Intercontinental Exchange (ICE) provide average market yields on high quality (AA) corporate bonds on a daily basis. For the eurozone, the following yields apply at 31 March 2021:

iBoxx benchmarks 31 March 2021

ICE benchmark (ER20) by maturity 31 March 2021

ICE benchmark (ER20) by duration 31 March 2021

The ICE index (ER29) provides data for bonds with a maturity of at least 10 years (similar to the iBoxx € Corporates AA 10+):

For the measurement of long term liabilities, the ICE index ER29 and the iBoxx € Corporates AA 10+ index are obviously the most relevant benchmarks. Both provide a yield of some 0.7% for 13 to 15 year durations at 31 March 2021.

Now, because most pension plans in Belgium provide a lump sum at retirement rather than a lifelong pension payment, the duration of those pension plans tends to be limited to 10 to 15 years. Hence, an bond indice with a similar duration can be used to determine the discount rate.

Because limited data is available for AA corporate bonds with longer durations, other approaches have been developped.

Yield curve approach

A second (more accurate) approach is based on a zero-coupon high quality corporate bond yield curve and the estimated benefit cash flows. The discount rate is set equal to the single equivalent discount rate, corresponding to the guidance in IAS 19.85:

“The discount rate reflects the estimated timing of benefit payments. In practice, an entity often achieves this by applying a single weighted average discount rate that reflects the estimated timing and amount of benefit payments and the currency in which the benefits are to be paid.“

The high quality corporate bond yield curve may be derived from market data about yields of (individual) high quality corporate bonds. When the number of high quality (AA) corporate bonds with longer maturities is limited (as usually the case for the Eurozone), solid market data about yields for longer maturities may not be available. For such cases, IAS 19.86 foresees:

“In some cases, there may be no deep market in bonds with a sufficiently long maturity to match the estimated maturity of all the benefit payments. In such cases, an entity uses current market rates of the appropriate term to discount shorter-term payments, and estimates the discount rate for longer maturities by extrapolating current market rates along the yield curve.”

The yield curve approach may result in a slightly higher discount rate depending on the cash flow pattern and the slope of the yield curve.

The following graph shows an example of a high quality corporate bond yield curve for the eurozone at 31 March 2021 using an approach applied by the Bundesbank for German GAAP purposes.

As you can see, the discount rates are based on the zero-coupon euro swap curve increased by a spread for high quality (AA) corporate bonds. The 0.47% spread equals the difference between the yield of the iBoxx € Corporates AA 10+ benchmark and the zero-coupon euro swap yield for a maturity corresponding to the duration of this benchmark.

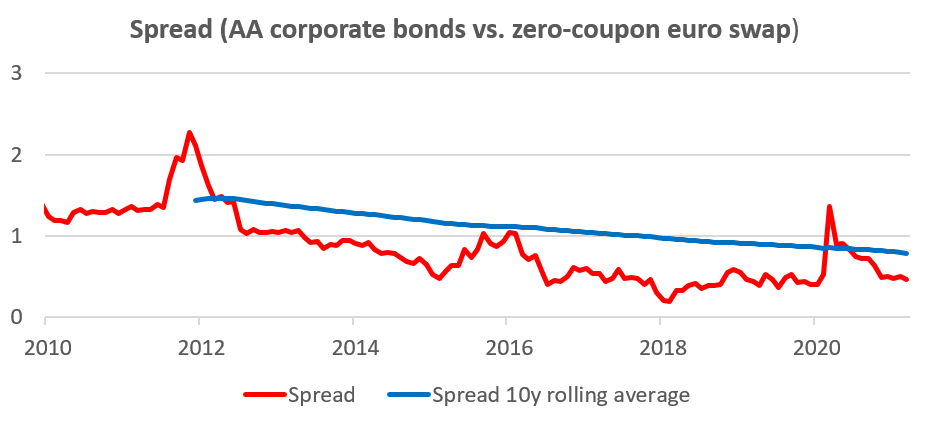

As you can see below, the spreads have been slowly decreasing during the last decade.

The spread is currently below the 10 year rolling average applied by the Bundesbank for measuring pension liabilities under German GAAP purposes.

Other approaches

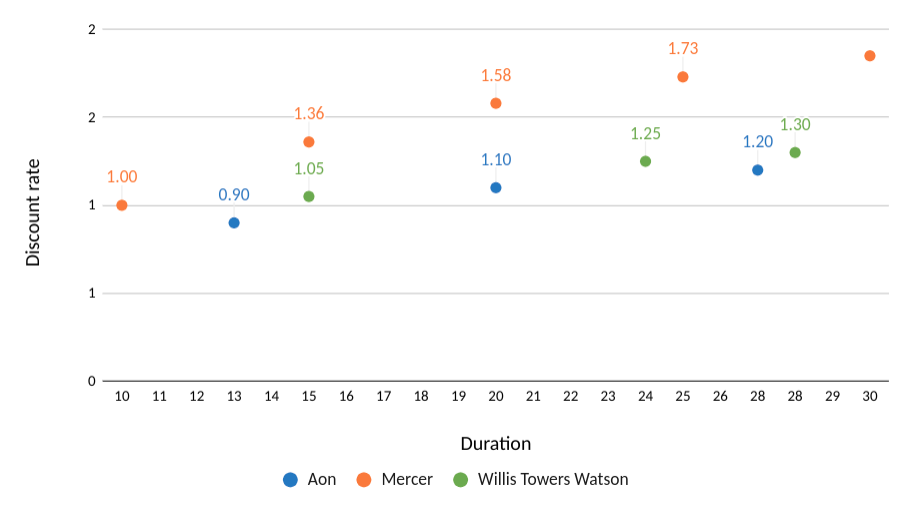

Some international actuarial consulting firms, such as Aon, Mercer or Willis Towers Watson, publish IAS 19 discount rates for the eurozone on their website. Those (single equivalent) discount rates are derived from a high quality corporate bond yield curve and a stream of typical benefit cash flows for different sample populations. These different populations (a young, mixed or mature population) reflect different durations of the benefit obligations. The following graph compares those discount rates at 31 March 2021:

The differences between those discount rates can be explained by differences in the criteria used to select high quality corporate bonds and, for longer maturities, the methodology used to construct the yield curve.

What discount rate you should use

There is no single right answer. Reach out and ask an expert which approach is most appropriate in your case.