As Belgian defined contribution pension plans are subject to minimum guaranteed rates of return, a provision may have to be recognized in the annual accounts.

At Pacti, we developed software that provides all of the information required for the financial reporting of such plans. Our approach focuses on cost efficiency, flexibility in terms of methodology and high quality reporting.

Background

Regulatory landscape

In accordance with the 28 April 2003 law regarding occupational pensions, pension plan sponsors have to guarantee minimum rates of return on contributions under Belgian defined contribution pension plans. Additionally, the law introduced the option to convert lump sums into a lifelong pension in which case minimum conversion factors apply (though in practice this option is rarely applied).

More details about this law can be found on the website of the Financial Services and Markets Authority (FSMA).

https://www.fsma.be/nl/aanvullend-pensioen-voor-werknemers /

https://www.fsma.be/fr/pension-complementaire-pour-les-travailleurs-salaries

Accounting implications

Due to the above-mentioned guarantees, Belgian defined contribution pension plans must be treated as defined benefit plans for accounting purposes.

For Belgian GAAP purposes, an advice was issued by the Accounting Standards Commission (the “Commissie voor Boekhoudkundige Normen / Commission des Normes Comptables”) regarding the accounting treatment of such plans. The CBN/CNC Advice 2018/15 basically stated that a provision is required if the employer retains a risk to fund any deficit (subject to materiality). Furthermore, the advice indicated that the methodology to be used to calculate such a provision would follow in a subsequent advice or technical note. Until now, no further guidance was issued however.

Based on general Belgian GAAP principles, it appears logical to calculate the provision as the discounted value of the expected future employer contributions required to guarantee the minimum rates of return on the accumulated reserves at the date of calculation.

https://www.cnc-cbn.be/fr/avis/traitement-comptable-dentre-autres-la-garantie-de-rendement-pour-les-cotisations-patronales

https://www.cbn-cnc.be/nl/adviezen/boekhoudkundige-verwerking-van-onder-meer-de-rendementswaarborg-voor-werkgeversbijdragen

Under IAS 19 – Employee Benefits, hybrid pension plans, such as defined contribution plans subject to minimum guaranteed rates of return, have to be treated as defined benefit plans. Hence, the benefit obligations and pension cost must be calculated based on the Projected Unit Credit method.

The IASB is still looking into an alternative treatment for hybrid pension plans but any fundamental changes are unlikely to occur in the short/medium term.

https://www.ifrs.org/projects/work-plan/pension-benefits-that-depend-on-asset-returns/

http://www.efrag.org/News/Project-366/Discussion-Paper–Accounting-for-Pension-Plans-with-an-Asset-Return-Promise

Minimum guaranteed rates of return

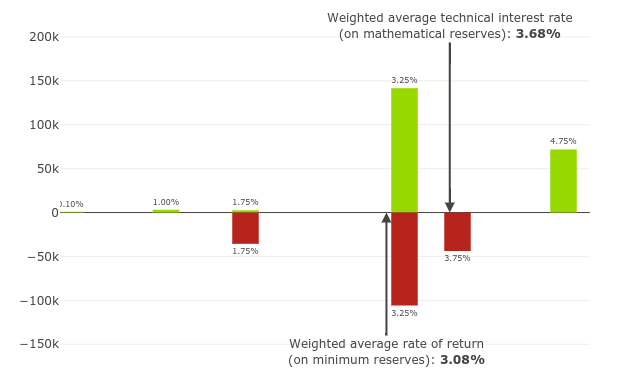

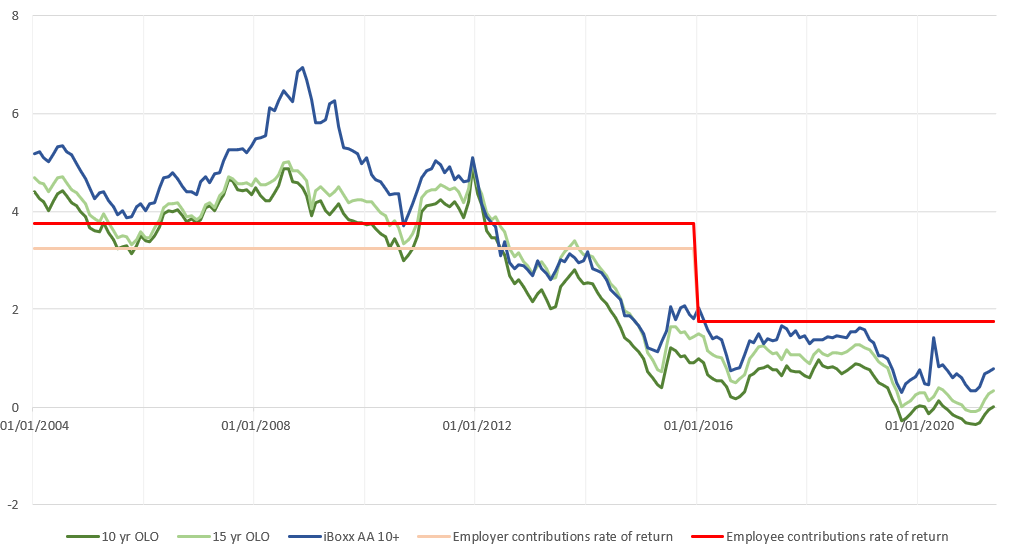

The minimum guaranteed rates of return under Belgian defined contribution pension plans were initially set to 3.25% on employer contributions and 3.75% on employee contributions. The minimum guaranteed rates of return were modified at the end of 2015 because of a significant decline in bond yields (as you can see in the graph below). Thus, as from 1 January 2016 onwards, the minimum guaranteed rates of return are annually recalculated based on the average yield of 10-year government bonds with a minimum of 1.75% and a maximum of 3.75%. Currently, the rate is equal to the minimum of 1.75% because of the low level of bond yields.

The above graph compares the minimum rates of return to be guaranteed on employer and employee contributions with :

- the yield on 10-year and 15-year bonds (OLOs), which can be considered as a benchmark for risk-free investments

- the iBoxx average yield of high quality (AA) corporate bonds in EUR with a term of at least 10 years, which can be considered as a benchmark for the IAS 19 discount rate

Illustration of impact of minimum guaranteed rates of return

In order to illustrate the potential cost impact of the minimum guaranteed rates of return, we look at an example of a pension plan funded through a so-called “branch 21” group insurance and a pension plan funded through a pension fund.

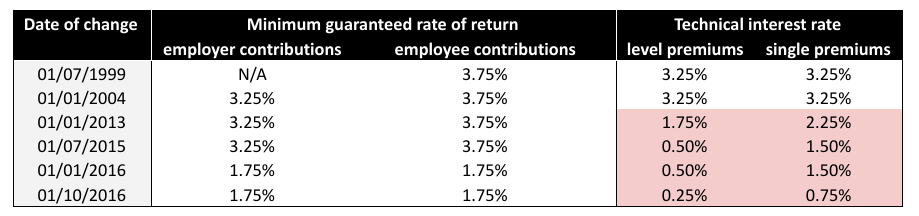

Within a branch 21 group insurance, the insurer guarantees a technical interest rate on the premiums. If the technical interest rate changes, the premium method determines whether the old rate is either guaranteed on past premiums (single premiums) or on both past and future premiums (level premiums).

When we compare the technical interest rates with the minimum guaranteed rates of return, we can see the gap became more important as from 2013 onwards.

The gap between what the insurer delivers and the minimum guaranteed rate of return should ultimately be funded by the employer. However, so far, the gap was largely compensated by profit sharing, which is granted each year a posteriori in the form of an additional rate of return. This may, however, become more difficult for insurers due to the continuous low level of bond yields.

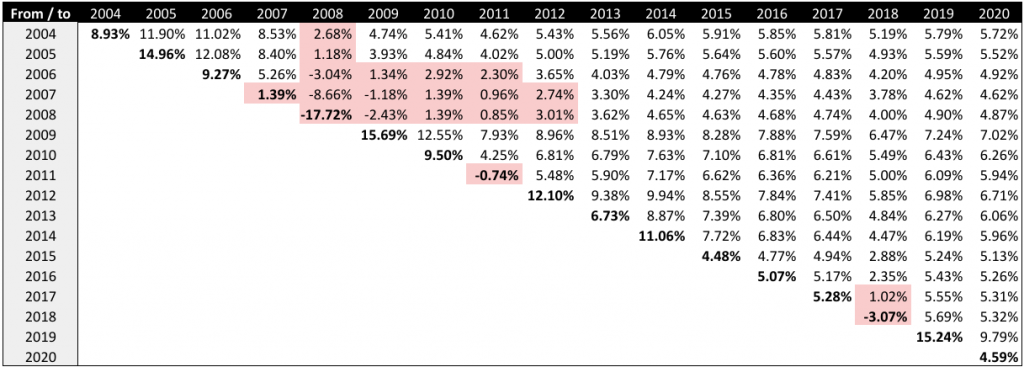

To illustrate the cost implications for pension plans funded through a pension fund, we use the average rates of return from a survey of PensioPlus (the Belgian association of pension funds). In the table below, we calculated the annualized average rates of return and highlighted the periods where it was lower than the annualized minimum guaranteed rate of return applicable to employer contributions.

Over the timespan 2004-2020, only 20 out of the 153 periods show a lower rate of return than the guaranteed minimum. Of course, the past is not necessarily a relevant indicator for the future.

How it works

Our model complies with IAS 19 and Belgian GAAP principles and works for all Belgian defined contribution plans.

Now, we need four types of input in order to carry out an actuarial valuation and get a report:

- the actuarial assumptions you want to use

- how the contributions are calculated

- last year’s valuation results (optionally)

- and finally, the plan participants’ data

We can assist you with selecting the appropriate assumptions and gathering the data. Then, we verify the data for reasonableness through a number of logic checks. Once validated, the model is ready to run.

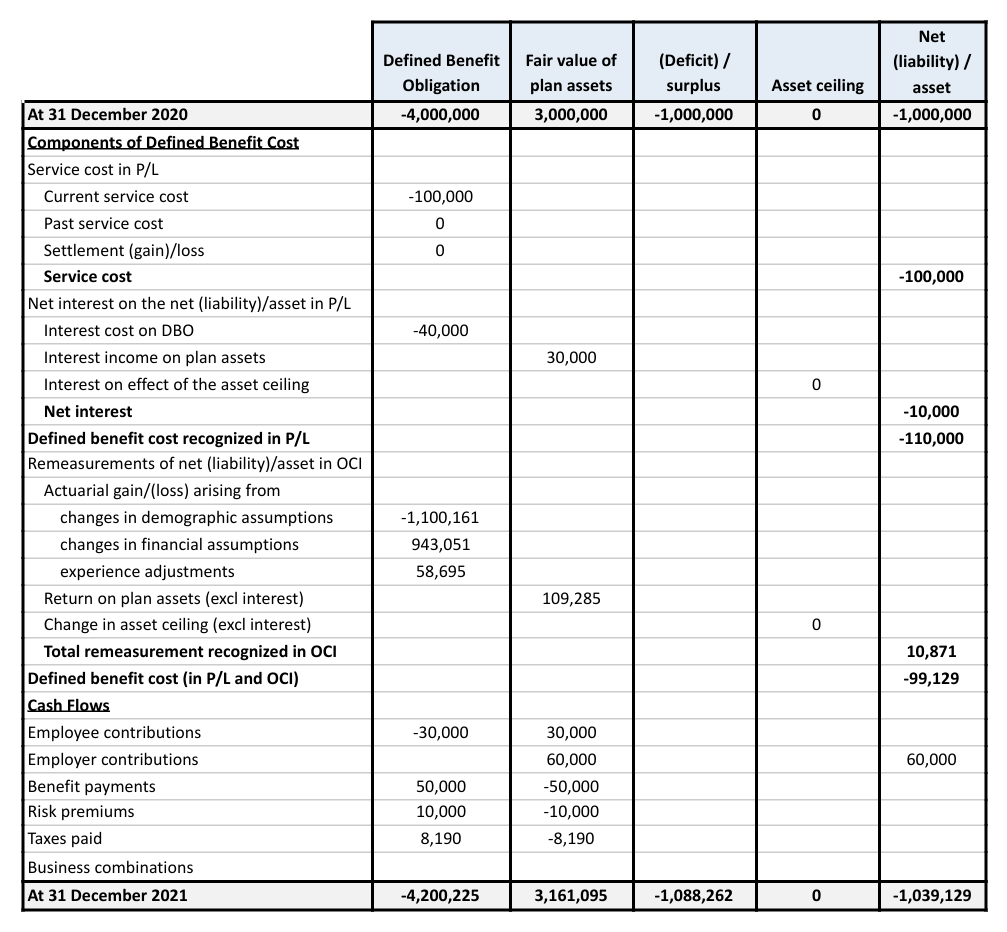

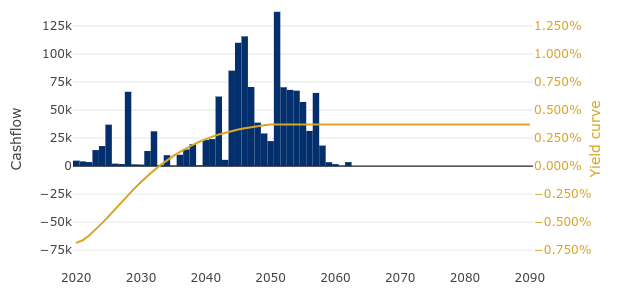

What you get

A reader friendly actuarial report including detailed valuation results, a sensitivity analysis, a reconciliation of IAS 19 figures and graphical representations of key findings.