An employee working in Belgium is covered by the social security scheme funded through employer and employee contributions. At the end of his career, the Belgian state provides a retirement pension. The so-called first pillar pension.

How it is calculated

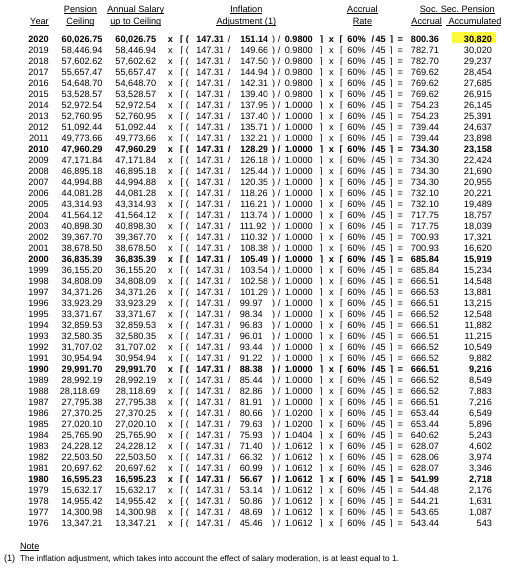

When you retire, you receive a pension that amounts to 1/45th of 60% of your annual salary for every year you worked, or 75% if your spouse does not receive a pension. Each annual salary is limited to the social security pension ceiling for that year, and subsequently revalued for inflation up to the date of retirement.

For example, the maximum pension you could earn for the year 2010 is:

1/45 x 60% x [47,960.29 x (147.31 / 128.29)] = €734.30

based on

- a pension ceiling for 2010 of €47,960.29

- an average inflation index for 2010 of 128.29

- an inflation index on 1/1/2021 of 147.31

Now, suppose you retired on 1th of January 2021 after a 45 year career as a salaried employee and your salary always exceeded the social security pension ceiling. The following table shows that your retirement pension would be €30,820 per year.

If you would like to calculate your own social security retirement pension, you can go to www.mypension.be.

How much will you get?

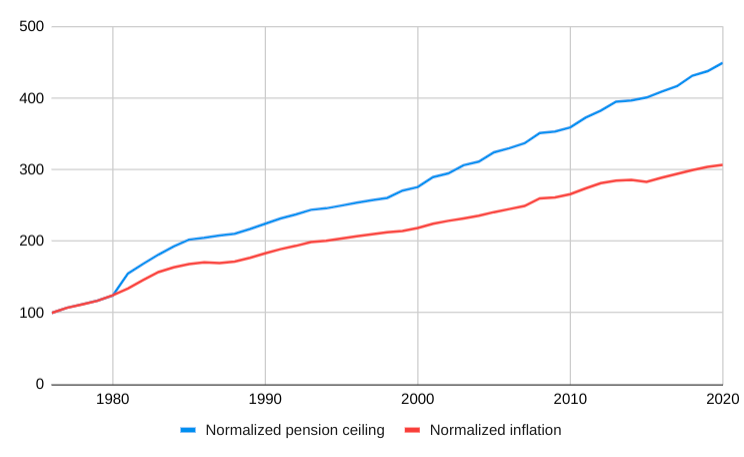

As you might have seen in the table above, the pension ceilings are increasing faster than the inflation. You can see the gap in the graph below.

As a result, the pension accruals are also structurally increasing: the maximum pension accrual for 2020 is almost 50% higher than for 1976 (€800 versus €543). In other words, each year’s generation of new pensioners is entitled to higher pension amounts.

As our social security scheme is funded on a pay-as-you-go basis, the incoming contributions are immediately used to pay out the pensions. An aging population puts pressure on the sustainability of such a pension scheme.

Other than a gradual increase of the retirement age, introduced by the previous government, no new measures appear to be foreseen to tackle the combined effect of an aging population and continuously increasing pension amounts in order to ensure sustainability of the scheme and fairness between generations. You can find more information here:

La réforme des pensions : dernier état des lieux | Service fédéral des Pensions (fgov.be)

Pensioenhervorming: de laatste stand van zaken | Federale Pensioendienst (fgov.be)